capital gains tax changes 2022

For single taxpayers and married individuals filing separately the standard deduction rises to 12950 for 2022 up 400 and for heads of households the standard deduction will be 19400 for tax year 2022 up 600. The five changes for 2022 that you need to know about AS MILLIONS of Britons make the most of the new year to get on top of their finances people are being reminded of some big changes taking place with Capital Gains Tax.

Top Personal Income Tax Rates In Europe 2022 Tax Foundation

Qualified dividend income shall not include any amount which the taxpayer takes into account as investment income under section 163.

. Capital gains tax reporting extended Another announcement in the Autumn Budget 2021 affects anyone who makes a capital gain after selling a property. Long-term capital gains are taxed at the rate of 0 15 or 20 depending on a combination of your taxable income and marital status. Washington implemented a 7 percent tax on long-term net capital gains in excess of 250000 beginning January 1 2022.

Remember this isnt for the tax return you file in 2022 but rather any gains you incur from January 1 2022 to December 31 2022. Key changes for companies. Since 1 July 2021 capital gains tax CGT does not apply when a granny flat arrangement is created varied or terminated.

There may well be some form of change to Capital Gains Tax rates but the annual exemptions will stay at 12300 for. Are the tax rates changing for 2022. Although the capital gains tax rates for long-term investments which are those youve held.

In addition to raising the capital-gains tax rate House Democrats legislation would create a 3 surtax on individuals modified adjusted gross income exceeding 5 million starting in. 4 rows If you sell stocks mutual funds or other capital assets that you held for at least one year any. The IRS typically allows you to exclude up to.

Capital Gains Changes in 2022. 1437 Thu Jan 6. Long-term capital gains are taxed at only three rates.

4 rows Capital Gains Taxes on Collectibles. Had significant tax changes take effect on January 1st. Tax rates on long-term capital gains ie gains from the sale of capital assets held for at least one year and qualified dividends did not change for 2022.

For single tax filers you can benefit from the zero percent. If you realize long-term capital gains from the sale of. Twenty-one states and DC.

The actual rates didnt change for 2020 but the income brackets did adjust slightly. Currently the capital gains tax rate for wealthy investors sits at 20. Starting in 2022 at least a portion of Long Term Capital Gains LTCG and Qualified Dividends will be taxed at ordinary tax rates for those whose adjusted gross income is more than 1 million.

The proposal is bumping this up to 396. 0 15 and 20. There is a change on the horizon which can take place as soon as 2022.

The rate jumps to 15 percent on. 500000 of capital gains on real. Real estate retirement savings accounts livestock and timber are exempt.

New tax laws for capital gains are also in place in 2022. Be aware of key changes and new measures when completing your clients 2022 tax returns. In other words if your long-term capital gains bring your taxable income 1.

In 2022 individual filers wont pay any capital gains tax if their total taxable income is 41675 or less. While there are no sweeping federal tax changes taking effect in 2022 there are several. See the latest 2022 state tax changes effective January 1 2022.

Capital gains are treated as ordinary income and taxed at the normal rate. The standard deduction for married couples filing jointly for tax year 2022 rises to 25900 up 800 from the prior year. Its not presently clear whether.

Key changes for individuals. Joe Biden says this tax increase funds. 250000 of capital gains on real estate if youre single.

7 rows Short-term capital tax gains are subject to the same tax brackets for ordinary incomes taxes. If your long-term capital gains take you into a higher tax bracket only the gains above that threshold will be taxed at the higher rate. Capital Gains Tax is currently charged at a flat rate of 18 for basic rate taxpayers.

For example if you have a stock with a capital gain and sell it. Previously there had been a window of just 30 days for taxpayers to report the gain and pay the tax owed - as of the Budget on 27 October 2021 - this was immediately increased to 60 days. The remaining 10000 of capital gain would be taxed at one of the 0 15 or 20 rates indicated above.

Capital Gains Tax is a confusing subject for many but the general rule is that Britons have a tax-free allowance which currently stands at 12300 or 6150 for trusts. If a persons taxable. A long-term capital loss you carry over to the next tax year will reduce that years long-term capital gains before it reduces that years short-term capital gains.

Key changes for attributed managed investment trusts AMITs.

2022 Corporate Tax Rates In Europe Tax Foundation

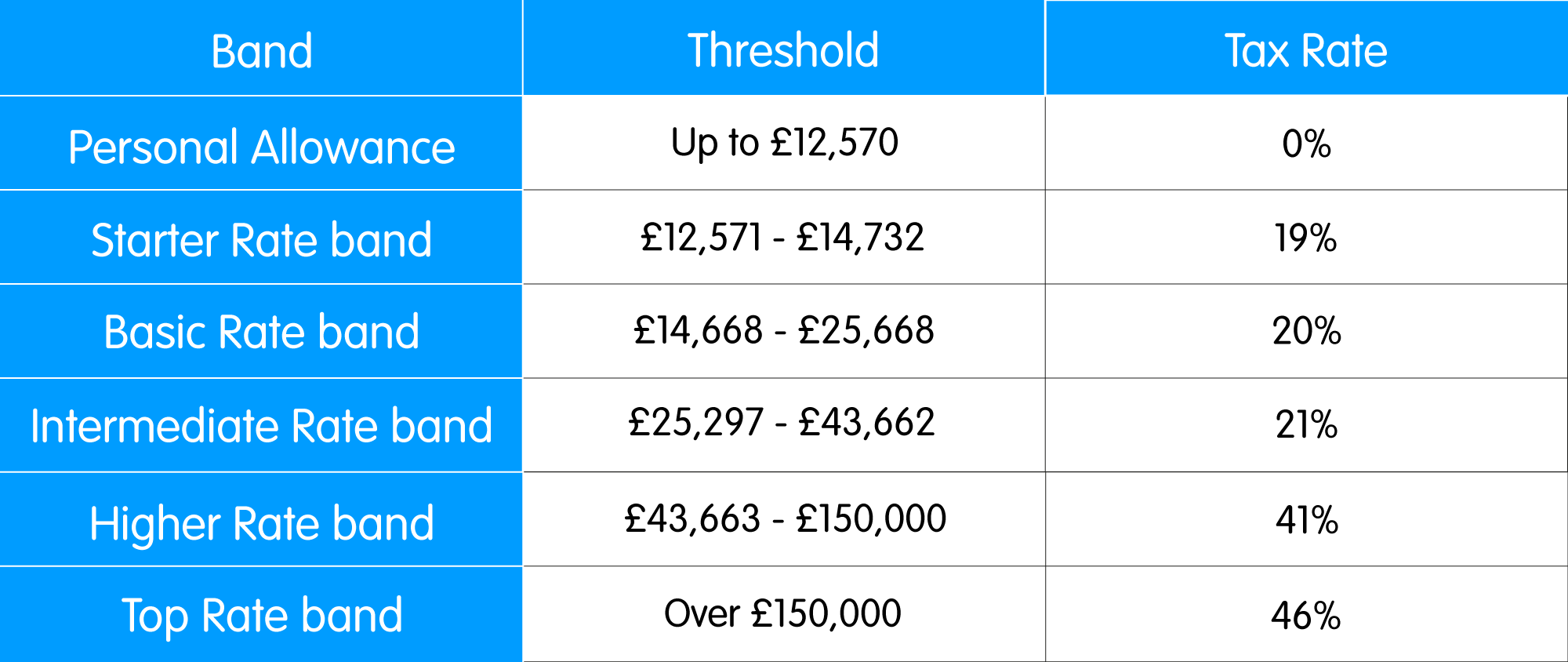

Preparing For The Tax Year 2022 23 Paystream

How To Pay Zero Taxes On Capital Gains Yes It S Legal Youtube In 2022 Capital Gain Capital Gains Tax Tax

Latest Income Tax Slab Rates For Fy 2021 22 Ay 2022 23 Budget 2021 Key Highlights Basunivesh

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Capital Gains Tax What Is It When Do You Pay It

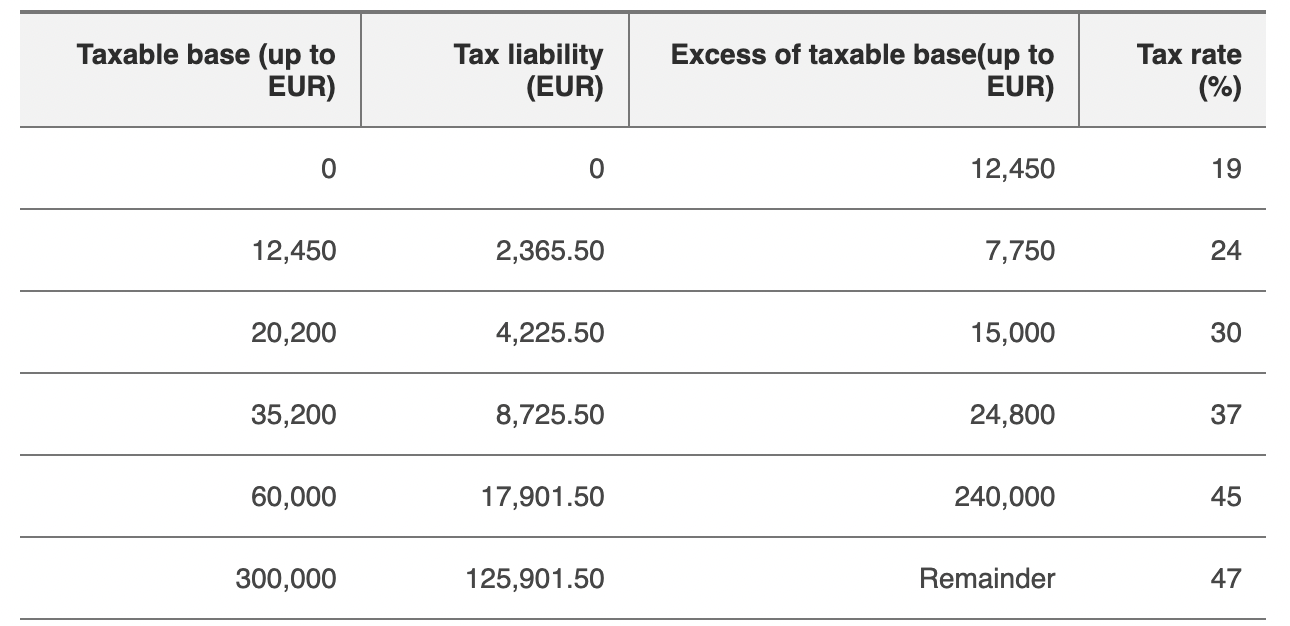

Expat Taxes In Spain 2022 Non Resident Tax Rates Spain

Difference Between Income Tax And Capital Gains Tax Difference Between

Capital Gain Tax On Transfer Of Unlisted Equity Shares

Income Tax Rates For Fy 2021 22 Ay 2022 23 Fy 2022 23 Ay 2023 24

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

Maryland Tax Rates Rankings Maryland State Taxes Tax Foundation

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Latest Income Tax Slab Rates For Fy 2021 22 Ay 2022 23 Budget 2021 Key Highlights Basunivesh

Capital Gains Tax Advice News Features Tips Kiplinger

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Capital Gains Taxation And Deferral Revenue Potential Of Reform Penn Wharton Budget Model

Capital Gains Tax Rate In California 2022 Long Short Term Seeking Alpha